-

Business Consulting

Our business consulting specialists offer a comprehensive blend of strategic advisory services. We assess the business, industry, operating model, synergy, skill sets and vision of the organisation and recommend the way forward

-

Digital Natives

Unlock growth with Grant Thornton Bharat's Digital Natives solutions. Customised support for tech-driven companies in healthcare, gaming, and more.

-

Digital Transformation Services

Grant Thornton’s digital transformation services help traditional businesses digitalise their business models with cloud technology, IoT consulting, app development and more DigiTech solutions.

-

Finance Transformation

Using a holistic approach, integrating digitalisation and digital transformation we help clients achieve transparency, control, governance, and faster decision making through real-time data within the business.

-

Human Capital Consulting

Our Human Capital Consulting team harnesses technology and industry expertise to assist in constructing adaptable organisations with transparency, fostering productive and value-driven workforces, and inspiring employees to engage meaningfully in their tasks.

-

Production Linked Incentive Scheme

Production-linked Incentive Scheme by the Indian government is aimed at boosting manufacturing. Grant Thornton Bharat offers varied services across sectors to help businesses avail of this scheme.

-

Public Sector Advisory

Our Public Sector Advisory team has focused streams, aligned with the core priorities of the Government of India. We are responsible for providing innovative and customized technical and managerial solutions.

-

Tech Advisory

We have amalgamated Digital Transformation, IT Advisory & Information Management and Analytics into a new offering, DigiTech.

-

Direct Tax services

Our tax specialists offer a comprehensive blend of tax services, tax litigation, regulatory and compliance services, helping you navigate through complex business matters.

-

Indirect Tax Services

Get tax services by leading tax firm Grant Thornton India. Our indirect tax services include consulting, compliance and litigation services for corporate, international and transaction tax

-

Transfer pricing services

Our transfer pricing services experts provide a range of services from provision of APA services to handling large global assignments including Country by Country reporting.

-

US Tax

At Grant Thornton, we help individuals and dynamic companies deal with US tax laws, which are one of the most complicated tax legislations across the world.

-

Financial Services - Tax

Best financial advisory services, tailored for small and large businesses by the experts having comprehensive knowledge of domestic laws and access to multifaceted tools to provide a valuable results.

-

Financial Reporting consulting services

Our experts have significant hands-on experience in providing IFRS/US GAAP services, end-to-end solutions and support services to fulfil financial reporting requirements.

-

Fund accounting and financial reporting

International operations often lack standardisation and have varied local reporting formats and requirements. Our experts can offer proactive insights, practical guidance, and positive progress and help meet regulatory timeframes.

-

Compliance and Secretarial Services

Our experts can assist in overhauling the entire compliance machinery of the organisation through evaluation of the applicable statutory obligations, monitoring of adequate governance controls, reporting and providing ongoing support.

-

Global People Solutions

As businesses transcend borders, both domestic and global considerations need equal attention. Our interim CFO and financial controller support services help organisations meet the business vision.

-

Finance and accounting outsourcing

Our accounting experts assist organisations in managing their accounting and reporting. Our dedicated Integrated Knowledge and Capability Centre (IKCC), allows us to service both the domestic and global markets efficiently and cost-effectively

-

Compliance Management System

We have automation solutions for you that will allow meeting government requirements and remain diligent, which when failed, can lead to penalties and loss in revenue.

-

Global compliance and reporting solutions

At Grant Thornton Bharat, we meet the challenges of our clients and help them unlock their potential for growth. Our professionals offer solutions tailored to meet our clients’ global accounting and statutory reporting requirements. With first-hand experience of local reporting requirements in more than 145+ locations worldwide, we provide seamless and consistent international service delivery through a single point of contact.

-

Related-party transaction governance

Related-party transactions (RPTs) are common in business structures where organisations engage with their group entities, such as holding companies, subsidiaries, associate concerns, joint ventures, or key management personnel, for various operational or financial purposes.

-

Family Offices & Private Client Services

Grant Thornton Bharat Private Client Services offers tailored advisory for family-owned businesses, focusing on governance, compliance, tax, succession planning, and family office structuring to sustain wealth and preserve legacies across generations.

-

GTMitra: Tax & Regulatory Tool

GTMitra, a specialised tax and regulatory tool by Grant Thornton Bharat, supports multinational businesses in understanding laws and regulations for effective growth strategies.

-

Labour codes

Labour codes solutions help you transition through the new legislation. At Grant Thornton, we help businesses divide their approach to make sure a smooth transition.

-

Alerts

At Grant Thornton India, with the help of our tax alerts, we help to provide updates on how to minimise your tax exposure and risks.

-

Unlocking opportunities: India investment roadmap

The India Investment Roadmap resource is designed to navigate the complexities of Indian tax and regulatory laws, providing seamless guidance and a comprehensive set of solutions to ensure a smooth process for investors aiming to establish or expand their presence in India.

-

CFO Solutions

Our comprehensive suite of solutions for CFOs

-

Cyber

In today’s time, businesses have gone through large transformation initiatives such as adoption of digital technologies, transition to cloud, use of advanced technologies et al.

-

Risk Optimisation

Our Governance, Risk and Operations (GRO) services encompass Internal Audit, Enterprise Risk Management, Internal Financial Controls, IT advisory, Standard Operating Procedures and other services.

-

Risk analytics

Grant Thornton Bharat’s CLEARR Insights is a state-of-the art data analytics platform that will help you in seamless data analysis and efficient decision-making.

-

Forensic & Investigation Services

The team of forensic advisory services experts consists of the best intelligence corporate experts, and fraud risk, computer forensic experts to deliver most effective solutions to dynamic Indian businesses.

-

ESG consulting

Grant Thornton Bharat offers holistic ESG consulting solutions for sustainable business outcomes. With industry expertise and AI technology, we drive long-term value.

-

Transaction Tax Services

Our transaction tax experts understand your business, anticipate your needs and come up with robust tax solutions that help you achieve business objectives ensuring compliance and efficiency

-

Deal Advisory

Unlike other M&A advisory firm in India, we offer deal advisory services and work exclusively with controlled and well-designed strategies to help businesses grow, expand and create value.

-

Due Diligence

Grant Thornton’s financial due diligence services are aimed at corporate looking for mergers and acquisitions, private equity firms evaluating investments and businesses/promoters considering sale/divestment.

-

Valuations

As one of the leading valuation consultants in India, Grant Thornton specializes in all the aspects of the process like business valuation services, financial reporting, tax issues, etc.

-

Overseas Listing

Overseas listing presents a perfect platform for mid-sized Indian companies with global ambitions. Grant Thornton’s team of experts in listings, work closely with clients during all stages.

-

Debt & Special Situations Solutions

Grant Thornton Bharat offers specialist debt and special situations consulting services, including restructuring, insolvency, and asset tracing solutions.

-

Financial Reporting Advisory Services

Grant Thornton Bharat Financial Reporting Advisory Services offer end-to-end solutions for complex financial requirements, including GAAP conversions, IPO support, and hedge accounting advisory, ensuring accurate financial reporting and compliance.

-

Financial Statement Audit and Attestation Services

Grant Thornton Bharat offers customised financial statement audit and attestation services, ensuring impeccable quality and compliance with global standards. Our partner-led approach, technical expertise, and market credibility ensure effective solutions for your business needs.

- Agriculture

- Asset management

- Automotive and EV

- Aviation

- Banking

- Education and ed-tech

- Energy & Renewables

- Engineering & industrial products

- Fintech

- FMCG & consumer goods

- Food processing

- Gaming

- Healthcare

- Urban infrastructure

- Insurance

- Media

- Medical devices

- Metals & Mining

- NBFC

- Pharma, bio tech & life sciences

- Real estate and REITs

- Retail & E-commerce

- Specialty chemicals

- Sports

- Technology

- Telecom

- Transportation & logistics

- Tourism & hospitality

-

Thought leadership Co-lending in India: Expanding credit access for MSMEsIn today’s rapidly evolving financial landscape, co-lending has emerged as a key enabler of credit expansion in India, facilitating partnerships between banks and non-banking financial companies (NBFCs) to extend credit more efficiently to underserved segments.

Thought leadership Co-lending in India: Expanding credit access for MSMEsIn today’s rapidly evolving financial landscape, co-lending has emerged as a key enabler of credit expansion in India, facilitating partnerships between banks and non-banking financial companies (NBFCs) to extend credit more efficiently to underserved segments. -

Article Why India’s financial inclusion journey needs to focus on equity and access to creditFinancial services have expanded over a decade, giving millions access to bank accounts and digital payments. But true empowerment needs to reach every corner of the country if growth is to be long-term and sustained

Article Why India’s financial inclusion journey needs to focus on equity and access to creditFinancial services have expanded over a decade, giving millions access to bank accounts and digital payments. But true empowerment needs to reach every corner of the country if growth is to be long-term and sustained -

Thought Leadership Competitive and sustainable agriculture & food processing in KeralaThe economy of Kerala is primarily driven by the services sector, which contributes 66% to the Gross State Domestic Product (GSDP).

Thought Leadership Competitive and sustainable agriculture & food processing in KeralaThe economy of Kerala is primarily driven by the services sector, which contributes 66% to the Gross State Domestic Product (GSDP). -

Article Economic Survey 2024-25: Deregulation, investment and innovation for a Viksit BharatIndia's economic growth remains for a steady trajectory with real GDP expected to grow at 6.4% in FY25 and in the range of 6.3%-6.8% in FY26, reflecting resilience despite global uncertainties.

Article Economic Survey 2024-25: Deregulation, investment and innovation for a Viksit BharatIndia's economic growth remains for a steady trajectory with real GDP expected to grow at 6.4% in FY25 and in the range of 6.3%-6.8% in FY26, reflecting resilience despite global uncertainties.

-

India-UK

India-UK

In a first, 15 banks in India have come together to establish a new company which will use blockchain technology for processing inland letters of credit (LCs). The company, named Indian Banks' Blockchain Infrastructure Co Pvt Ltd (IBBIC), will have equal shareholding from 10 private sector banks, four public sector banks and one foreign bank.

This include RBL Bank, ICICI Bank, HDFC Bank, Kotak Mahindra Bank, Axis Bank, IndusInd Bank, Yes Bank, South Indian Bank, Federal Bank, IDFC First Bank, State Bank of India (SBI), Bank of Baroda (BoB), Indian Bank, Canara Bank and Standard Chartered. Each bank will invest INR 5 Crore in the company, making the total capital INR 75 Crores. As per reports, the Reserve Bank of India (RBI) has also been kept in loop on the developments and the regulator has no objection in this new venture. This is an interesting development, as Institute for Development and Research in Banking Technology (IDRBT), the technology and research arm of RBI, is also in the process of developing a model blockchain platform for banking needs.

IBBIC will use Infosys Finacle Connect platform to digitise and automate inter-organisation trade finance process on a unified distributed, trusted and shared network. With this, the banking system in India is taking a new leap in digitisation of trade finance, which has traditionally been bogged down by legacy systems and paper-driven processes. The move comes at a time when blockchain technology prototypes across the globe are fast-moving out from experimentation phase to deployment and the government is set to introduce blockchain and cryptocurrency regulations in India.

For many, the blockchain technology is still synonymous with bitcoin which came to existence in 2009. When Satoshi Nakamoto introduced bitcoin to the world, it ushered in a new era of computing – ‘the internet of trust’, a way to record transactions in a secure, immutable and transparent way. The consequences of bitcoin and the underlying technology were far-reaching, with the potential to revolutionalise everything from finance to politics. The basic concept of blockchain is to decentralise and distribute data storage so that no single entity owns, controls or manipulates data, thus providing a single source of truth.

Trade is essentially a decentralised activity and it has many intermediaries - financiers, insurers and other parties. This is a typical scenario where trust and a single source of truth are of paramount importance. The volume of documentation that happens between parties involved in establishing the ‘trust’ is humungous. The cost and time associated with preparing, transmitting and validating these documents can be counted in thousands of crores of rupees. Not to mention the losses due to instances of deceit and forgery. A blockchain, acting as a shared ledger can maintain real-time records of transactions among supply chain stakeholders, enhancing transparency in transactions and traceability of the supply chain. Creating such trusted digital data flows can reduce costs, make transactions error-free and enable faster transactions.

In India, frauds associated with LCs have been a cause of concern. It is difficult to verify the authenticity of LCs issued in physical format. In a notification by RBI to banks in 2012, issuances of LCs were made mandatorily through Structured Financing Messaging System (SFMS). SFMS is managed by Indian Financial Technology and Allied Services (IFTAS), a wholly-owned subsidiary of the Reserve Bank of India. This enhanced the verification capabilities for the banks to some extend. In 2020, a new document embedding feature was developed on SFMS by IDFC Intech, which allowed transmitting pdf documents with digital signature along with the messages, thereby enabling the parties to maintain documentary evidence for all transactions. But, the information exchange possible on the SFMS system is still limited, and does not completely eliminate the risk of duplicate

financing and fraud.

Before formation of IBBIC, Infosys Finacle had formed India Trade Connect in 2018, a blockchain-based trade network in partnership with Axis Bank, ICICI Bank, IndusInd Bank, Kotak Mahindra Bank, RBL Bank, South Indian Bank and Yes Bank. The network created was used by the banks to run a successful pilot of Finacle Trade Connect - the blockchain technology-based solution currently adopted by IBBIC. The newly formed company, with a larger participation is the positive outcome of successful pilots conducted by the Trade Connect initiative. The company is expected to launch the platform and become fully operational in less than a year. It will have an open structure, which will allow new banks to invest and participate, thereby creating strong network effects.

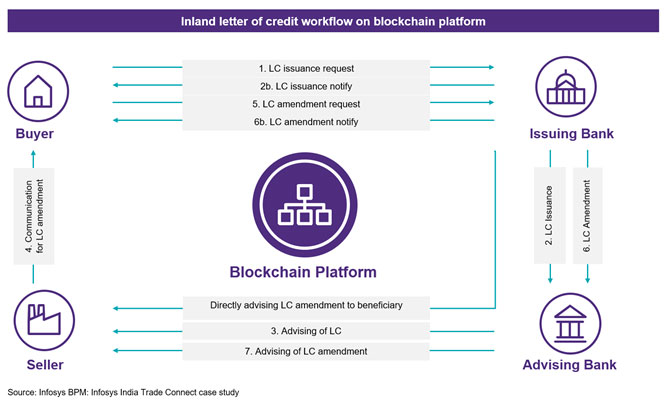

As per the details available on India Trade Connect, the blockchain network is designed to digitise trade finance business processes, including validation of ownership, certification of documents and making payments, on a distributed, trusted and shared network. The network will create new business opportunities for participating banks, while eliminating the inefficiencies in the existing trade processes and enabling everyone involved in a transaction to have a single source of the truth. The network allows for instant transfer of messages and documents between the parties involved in a completely secure manner reducing lifecycle turnaround time. The pilot run showed significant cut in cycle time for inland letter of credit; a reduction of 75% from 8-9 days to 2-3 days. Also, the digitisation reduced cost in two major areas - document courier expenses and transaction cost associated with intermediary messaging systems. As invoices and other documents were uniquely identified and stored on the blockchain, risk of duplicate financing reduced significantly. The workflow inland letter of credit issuance on the platform is illustrated as follows:

Incorporation of independent companies to run blockchain platforms is not new. Leading global blockchain trade finance platforms such as Komgo, We.trade and Contour started out as consortia of banks and other companies. All the three have moved away from that initial model and now function as separate legal entities. This is seen as essential to maintain good governance and neutrality of the platform. Independent entity can ensure that members are sharing data with a neutral entity and none of the members take undue advantage of the data available on the platform. These newly formed companies are currently running proof of concepts with the existing partners and are adding new partners at a rapid rate. Komgo, considered as world’s first blockchain-based platform for commodity trade ecosystem is backed by 15 of the world’s largest global banks, trading companies and oil giants (including BNP Paribas, Citi, ING, MUFG). Komgo supported close to USD 1 billion financing channelled by network members within one year of its public launch. Major challenge faced by all the platforms the limited network effects without numerous banks in production.

Table 1: Leading global blockchain based trade finance platforms

| Platform | Launch year | Participating institutions | Transaction volume | Technology |

| Komgo | 2019 | ABN-AMRO, BNP Paribas, Credit Agricole, Citi, Gunvor, ING, Koch Supply & Trading, Macquarie, Mercuria, MUFG Bank, Natixis, Rabobank, SGS, Shell, Société Générale | USD 1 billion | ConsenSys Quorum |

| We.Trade | 2018 | CaixaBank, Deutsche Bank, Erste Group, HSBC, KBC, Nordea, Rabobank, Santander, Société Générale, UBS and UniCredit | - | IBM Blockchain platform |

| Contour | 2020 | Bangkok Bank, BNP Paribas, CTBC Holding, HSBC, ING, SEB, and Standard Chartered, Citi, Vietnam’s HD Bank, DBS Bank, SMBC and Standard Bank |

USD 1 billion | R3 Corda platform |

| Marcopolo | 2019 | BNP Paribas, Commerzbank, ING, LBBW, Anglo-Gulf Trade Bank, Standard Chartered Bank, Natixis, Bangkok Bank, SMBC, Danske Bank, NatWest, DNB, OP Financial Group, Alfa-Bank, Bradesco, BayernLB, Helaba, S-Servicepartner, Raiffeisen Bank International, Standard Bank, Credit Agricole and National Bank of Fujairah. |

USD 3.3 billion | R3 Corda platform |

Meanwhile, private blockchains owned by Chinese banks have clocked large transaction volumes. Recently, an Ethereum-based private blockchain platform developed by China Construction Bank called BCTrade clocked transactions worth USD 50 billion, thereby making it the largest trade finance platform in the world. The bank runs the platform through its subsidiary - Jianxin Financial Services. Industrial and Commercial Bank of China, world’s largest bank by assets, also owns a blockchain trade finance platform which has clocked transactions worth USD 6.5 billion so far.

Blockchain technology is still considered to be in its infancy and is often compared to the internet in early 90’s. The applications are not limited to trade finance or cross border payments. Several banking consortiums have emerged worldwide in the last few years in collaboration with technology providers to advance the use of blockchain and find new application areas in financial services. The regulatory landscape is also evolving taking cognisance of the fast-paced developments.

IBBIC, the newly incorporated entity with stakes from top banks in the country is a potential game-changer for BFSI sector in India. Though the scope is currently limited to addressing issues in trade financing, the company can also bring focus to research, exploration and implementation of new blockchain solutions and keep the financial services sector in India at the leading edge of innovation. The company can also collaborate with GoI and regulators to shape regulations in a meaningful way so that the full potential of blockchain technology is unlocked and an enabling environment is created for new advances.