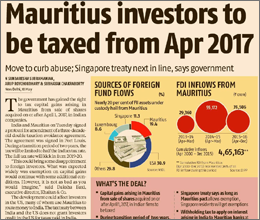

"Grandfathering of investments till 31 March 2017 provides some breather to the existing investors and the fund houses. The reduced tax rate with 50% of the domestic rate of tax in India, during the transition period of two years from April 2017 to March 2019 is a bit a show stopper unlike the India- Singapore treaty since as per the India-Mauritius protocol fulfilment of Limitation of Benefit will only entitle the investors to a 50% reduction of tax rates."

Manoj Purohit

Director, Grant Thornton Advisory Private Limited

This article appeared in Business Standard on 11th May, 2016

Also appears under...