-

Business Consulting

Our business consulting specialists offer a comprehensive blend of strategic advisory services. We assess the business, industry, operating model, synergy, skill sets and vision of the organisation and recommend the way forward

-

Digital Transformation Services

Grant Thornton’s digital transformation services help traditional businesses digitalise their business models with cloud technology, IoT consulting, app development and more DigiTech solutions.

-

Human Capital Consulting

Our Human Capital Consulting team harnesses technology and industry expertise to assist in constructing adaptable organisations with transparency, fostering productive and value-driven workforces, and inspiring employees to engage meaningfully in their tasks.

-

Production Linked Incentive Scheme

Production-linked Incentive Scheme by the Indian government is aimed at boosting manufacturing. Grant Thornton Bharat offers varied services across sectors to help businesses avail of this scheme.

-

Public Sector Advisory

Our Public Sector Advisory team has focused streams, aligned with the core priorities of the Government of India. We are responsible for providing innovative and customized technical and managerial solutions.

-

Tech Advisory

We have amalgamated Digital Transformation, IT Advisory & Information Management and Analytics into a new offering, DigiTech.

-

Direct Tax services

Our tax specialists offer a comprehensive blend of tax advisory, tax litigation, regulatory and compliance services, helping you navigate through complex business matters.

-

Indirect Tax Services

Get tax advisory service by leading tax firm Grant Thornton India. Our indirect tax services include advisory, compliance and litigation services for corporate, international and transaction tax

-

Transfer pricing services

Our transfer pricing services experts provide a range of services from provision of APA services to handling large global assignments including Country by Country reporting.

-

US Tax

At Grant Thornton, we help individuals and dynamic companies deal with US tax laws, which are one of the most complicated tax legislations across the world.

-

Financial Services - Tax

Best financial advisory services, tailored for small and large businesses by the experts having comprehensive knowledge of domestic laws and access to multifaceted tools to provide a valuable results.

-

Financial Reporting consulting services

Our experts have significant hands-on experience in providing IFRS/US GAAP services, end-to-end solutions and support services to fulfil financial reporting requirements.

-

Fund accounting and financial reporting

International operations often lack standardisation and have varied local reporting formats and requirements. Our experts can offer proactive insights, practical guidance, and positive progress and help meet regulatory timeframes.

-

Compliance and Secretarial Services

Our experts can assist in overhauling the entire compliance machinery of the organisation through evaluation of the applicable statutory obligations, monitoring of adequate governance controls, reporting and providing ongoing support.

-

Global People Solutions

As businesses transcend borders, both domestic and global considerations need equal attention. Our interim CFO and financial controller support services help organisations meet the business vision.

-

Finance and accounting outsourcing

Our accounting experts assist organisations in managing their accounting and reporting. Our dedicated Integrated Knowledge and Capability Centre (IKCC), allows us to service both the domestic and global markets efficiently and cost-effectively

-

Compliance Management System

We have automation solutions for you that will allow meeting government requirements and remain diligent, which when failed, can lead to penalties and loss in revenue.

-

IKCC: Grant Thornton's Shared Service Centre

The India Knowledge and Capability Centre (IKCC), aimed at delivering solutions by developing capabilities, has completed four years of its journey.

-

Global compliance and reporting solutions

At Grant Thornton Bharat, we meet the challenges of our clients and help them unlock their potential for growth. Our professionals offer solutions tailored to meet our clients’ global accounting and statutory reporting requirements. With first-hand experience of local reporting requirements in more than 145+ locations worldwide, we provide seamless and consistent international service delivery through a single point of contact.

-

Related Party Transactions Governance

Related Party Transactions Governance

-

Private Client Services

Private Client Services

-

Alerts

At Grant Thornton India, with the help of our tax alerts, we help to provide updates on how to minimise your tax exposure and risks.

-

Labour codes

Labour codes solutions help you transition through the new legislation. At Grant Thornton, we help businesses divide their approach to make sure a smooth transition.

-

Cyber

In today’s time, businesses have gone through large transformation initiatives such as adoption of digital technologies, transition to cloud, use of advanced technologies et al.

-

Governance, Risk & Operations

Our Governance, Risk and Operations (GRO) services encompass Internal Audit, Enterprise Risk Management, Internal Financial Controls, IT advisory, Standard Operating Procedures and other services.

-

Risk analytics

Grant Thornton Bharat’s CLEARR Insights is a state-of-the art data analytics platform that will help you in seamless data analysis and efficient decision-making.

-

Forensic & Investigation Services

The team of forensic advisory services experts consists of the best intelligence corporate experts, and fraud risk, computer forensic experts to deliver most effective solutions to dynamic Indian businesses.

-

ESG consulting

Grant Thornton Bharat offers holistic ESG consulting solutions for sustainable business outcomes. With industry expertise and AI technology, we drive long-term value.

-

Transaction Tax Services

Our transaction tax experts understand your business, anticipate your needs and come up with robust tax solutions that help you achieve business objectives ensuring compliance and efficiency

-

Deal Advisory

Unlike other M&A advisory firm in India, we offer deal advisory services and work exclusively with controlled and well-designed strategies to help businesses grow, expand and create value.

-

Due Diligence

Grant Thornton’s financial due diligence services are aimed at corporate looking for mergers and acquisitions, private equity firms evaluating investments and businesses/promoters considering sale/divestment.

-

Valuations

As one of the leading valuation consultants in India, Grant Thornton specializes in all the aspects of the process like business valuation services, financial reporting, tax issues, etc.

-

Overseas Listing

Overseas listing presents a perfect platform for mid-sized Indian companies with global ambitions. Grant Thornton’s team of experts in listings, work closely with clients during all stages.

-

Debt & Special Situations Solutions

Grant Thornton Bharat offers specialist debt and special situations consulting services, including restructuring, insolvency, and asset tracing solutions.

-

Financial Reporting Advisory Services

Financial Reporting Advisory Services

-

Financial Statement Audit and Attestation Services

Financial Statement Audit and Attestation Services

- Agriculture

- Asset management

- Automotive and EV

- Aviation

- Banking

- Education and ed-tech

- Energy & Renewables

- Engineering & industrial products

- FinTech

- FMCG & consumer goods

- Food processing

- Gaming

- Healthcare

- Urban infrastructure

- Insurance

- Media

- Medical devices

- Metals & Mining

- NBFC

- Pharma, bio tech & life sciences

- Real estate and REITs

- Retail & E-commerce

- Specialty chemicals

- Sports

- Technology

- Telecom

- Transportation & logistics

- Tourism & hospitality

-

India-UK

India-UK

The approved Production Linked Incentive (PLI) scheme for the auto sector with an outlay of INR 26,058 crore has undoubtedly repositioned the focus from making the sector self-reliant to bolstering the adoption of technology-driven indigenous production of vehicles and components.

The draft includes four major schemes – component champion, vehicle champion, global sourcing and product-linked incentives – which have been aligned to a similar goal of making the Indian auto sector ‘Aatmanirbhar’ or self-reliant with technological advancements.

With the updated draft of this scheme, the government has been transparent with its intention to provide financial incentives to boost domestic manufacturing of advanced automotive technology products and simultaneously attract investments in manufacturing value chain.

The scheme would allow overcoming cost disabilities, creating economies of scale and building a robust supply chain for products that are technologically advanced. However, original equipment manufacturers (OEMs) and component manufacturers would need to invest first to avail the incentives.

Need To Increase Capital Expenditure

With the scheme focused at transforming the country as a manufacturing hub, the auto and auto-component manufacturers are expected to increase capital expenditure to meet revenue commitment under the scheme and avail the incentives. The first and foremost step taken by OEMs, therefore, should be in line with increased capital expenditures that would allow them to move up the value chain with higher value-added products.

Fenner Madurai plant (representational image).

Fenner Madurai plant (representational image).

To facilitate for the new tech vehicles and its components, research and development (R&D) investments also need to be expanded. The investments in R&D (especially for component makers) needs to be aggravated, as the current investments are relatively on a lower-end.

Financing the scheme will not only generate employment, but will also expand the potential for exports, making indigenous products eligible for international markets. The government has projected fresh investments of over INR 42,500 crore along with an incremental production of over INR 2.3 lakh crore. These investments in capital expenditure are expected to be made from global players/ new entrants in the market along with domestic stakeholders.

With transition to e-mobility space, India can reposition itself in the global automotive industry and become one of the largest markets for electric vehicles (EVs). To attain this status, component manufacturers should look at global EV manufacturers and find out ways to add value to manufacturing in India.

For component manufacturers, Tier II and Tier III would need to maintain quality and come at par with components manufactured on a global scale. Going forward, this should remain uncompromised. Similarly, the onus of leading the Tier II and Tier III suppliers to maintain product quality and ensuring its technological advancement falls primarily on Tier I.

Meeting such expectations would allow OEMs, component makers and non-automotive companies in the ecosystem to avail incentives.

Incentives At A Glance

- For auto OEMs, global group revenue should be a minimum INR 10,000 crore, whereas the global investment of the company or its group companies in fixed assets (gross block) of INR 3,000 crore.

- For auto component manufacturers, global group revenue should be a minimum INR 500 crore, whereas the global investment of the company or its group companies in fixed assets (gross block) of INR 150 crore.

- Under champion and component incentive scheme, INR 2,000 crore and INR 250 crore needs to be made, respectively, over the next five years.

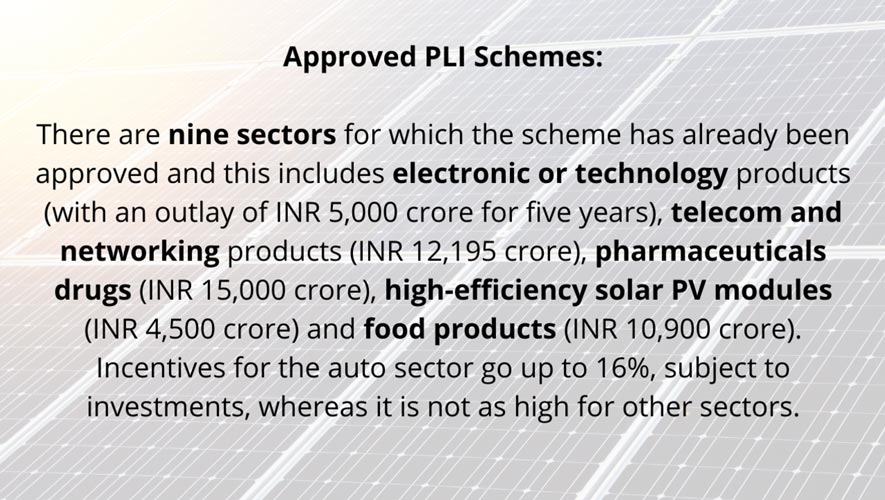

PLI schemes approved by Government of India.

PLI schemes approved by Government of India.

While The Scheme Looks Promising, Roadblocks Persist

Though the PLI scheme remains optimistic for creating global manufacturing hubs in India, it is more favourable to large entities with huge domestic and export turnover. Other companies with a limited product range and constraints on capacity would find it difficult to fit into the strict eligibility criteria. Considering the Indian automotive landscape, many start-ups have been trying to grab the market share of developing EV ecosystem, however, it is likely they would fail to avail incentives under the PLI scheme due to failure in meeting the eligibility criteria.

Moreover, auto giants in the sector would need to plan their investments accordingly for latest technologies in the EV space. A majority share of vehicle plying on Indian roads are still internal combustion engine (ICE) powered. As per a Bloomberg report, India would still need another decade to reach 30% electrification.

Despite major schemes and policies, the share of investment for e-mobility in India is extremely low on the back of scalability and infrastructure constraints and it is largely confined to the two-wheeler segment. While impetus to establish a complete EV ecosystem is being given, manufacturers cannot completely do away with ICE for the next few years.

This article was originally published in Mobility Outlook.